2106

2106

2017-03-16

2017-03-16

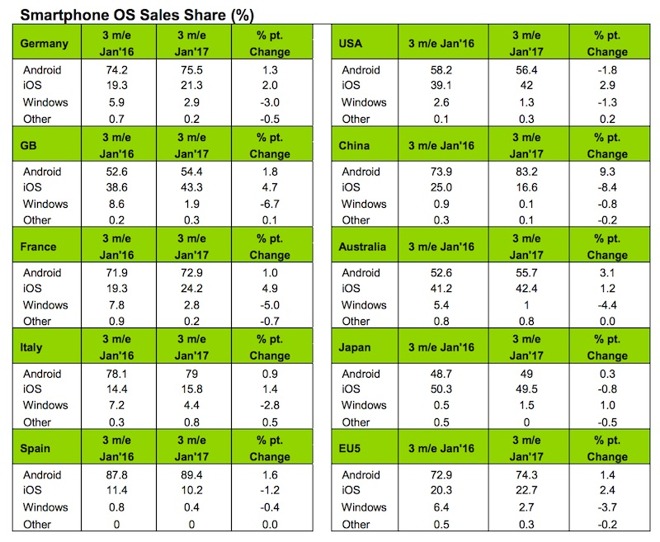

A new report by Kantar Worldpanel examining global smartphone sales data shows Apple's flagship iPhone 7 continues to win new market share for Apple in most of the regions tracked, outside of Spain, China and Japan.

The firm's data on the three months ending in January showed 2.9 percentage points of new market share in the U.S. over last year to claim 42 percent of sales in the period, gains made at the expense of both Android and Windows Mobile.

In Europe's top five markets, Apple climbed a similar 2.4 percentage points but remains at a smaller share of the market with 22.7 percent share, figures that include sales of much cheaper phones.

However, the report noted that "iPhone 7 remained "the top-selling device in Great Britain, France, and Germany," highlighting that market share alone doesn't say anything about sustainable profitability. The only reported European country where Apple's share fell was Spain.

Apple's share in Austrailia reached 42.4 percent, slightly higher than its proportion of sales in the U.S.Apple continues to collect the vast majority of profits in the smartphone market

In China, Apple's overall share of the entire market fell by 8.4 percent, but those figures include large volumes of phones being sold in tier 2 and tier 3 cities in more rural areas, where many buyers are new the growing market.

In "Urban China," a reference to its massive modern cities, Apple continues to sell the most premium phones. "iPhone 7 remains the top-selling smartphone in Urban China," Kantar noted.

Apple's share also fell slightly in Japan over the past year, but remains at 49.5 percent market share, the highest figure of any country.

The report stated that "re-born brand names" Nokia and BlackBerry made "a splash with retro market features and styling," but also acknowledged that "no other ecosystem is challenging the two giants - iOS and Android."

Apple continues to collect the vast majority of profits in the smartphone market. Last year, it earned 5.4 times the profits of Samsung as its various rivals in China (Huawei; BBK subsidiary brands Oppo and Vivo; Xiaomi and ZTE) all collectively amounted to less than 5 percent of the industry's profits, despite the surge of new phones being produced in China that helps to depress Apple's market share there.

Source: appleinsider