2102

2102

2017-05-03

2017-05-03

There was a time when Apple investors were loath to call it a "dividend stock." Now it's the biggest dividend stock there is.

Apple announced after the bell Tuesday a 10.5 percent increase in its dividend to $13.22 billion annually, surpassing Exxon Mobil's $12.77 billion payout and making it the biggest-paying dividend stock in the world.

The iPhone maker reported quarterly earnings after the bell which slightly disappointed Wall Street as sales fell short of estimates. But it also said it was hiking its quarterly dividend to 63 cents a share from 57 cents a share.

The giant payout increase, a luxury made possible by the tech company's now $256.8 billion cash hoard, should help cushion the blow.

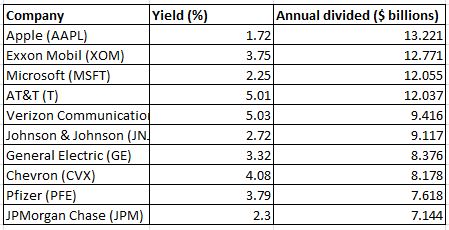

Biggest annual dividends in the S&P 500

This is the fifth annual dividend hike since Apple initiated its first payout in 2012, according to S&P Dow Jones Indices. This increase is bigger than last year's 9.6 percent hike, but short of the 15 percent increase back in 2013, according to S&P Dow Jones.

"They pay out more than U.S. Steel is worth," wrote Howard Silverblatt, senior index analyst and data guru with S&P Dow Jones Indices, who trumpeted the payout in an email shortly after Apple's earnings hit.

To be sure, Exxon still pays a higher dividend yield than Apple (3.75 percent to 1.72 percent) because its share price is lower. The oil producer long loved by investors for its payout increased its dividend for the 35th year in a row last week by 2.7 percent to 77 cents a share, Silverblatt notes.

What's most shocking about Apple's dividend is that it could easily be even bigger if the company didn't also choose to deploy some capital via share repurchases. The tech giant announced after the bell that it was upping its buyback program by $35 billion and plans to spend a total of $210 billion buying back its stock by the end of March 2019.

Source: CNBC