1698

1698

2019-05-07

2019-05-07

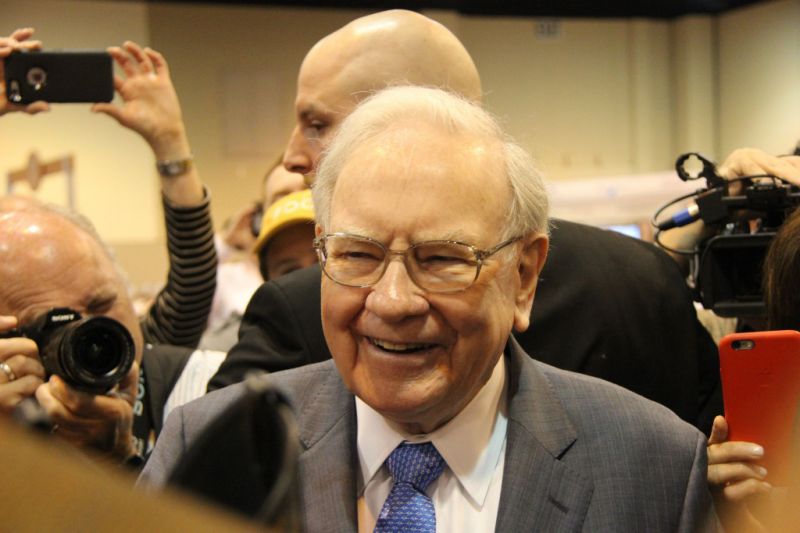

Buffett kicked off a discussion of Apple's share repurchases when CNBC's Becky Quick told the Berkshire chairman and CEO that Apple shares were down several percentage points on Monday morning. "Well that's good," Buffett responded.

He went on to explain that lower prices are better for the company's buybacks.

Further, Buffett advocated for Apple's repurchases, saying that "when they repurchase shares, our interest goes up and we don't lay out a dime. I love it."

Asked specifically about whether Buffett supports Apple's just-announced $75 billion share repurchase authorization, he said he's "wildly in favor of it."

The Berkshire CEO clarified that not all repurchases are smart. They "can be the dumbest thing in the world or the smartest thing in the world," he said. He went on to explain that their value to shareholders depends on the price at which companies are buying back shares. "They're dumb and one price and they're smart at another price." Buffett's approval of Apple's repurchase program, therefore, suggests he believes Apple shares are a good deal at this level.

Making Apple's buybacks even more valuable, the company has been opportunistic about its share repurchases in the past, loading up on shares more aggressively when the stock falls.

Berkshire, of course, has a vested interest in the intrinsic value of Apple stock. The tech giant is Berkshire's largest equity holding. The conglomerate's stake in Apple is currently valued at a whopping $52 billion.

Source: Yahoo